The revision of the F-Gas Regulation

For several years, the European Commission has been working on the revision of the F-Gas regulation, known as F-Gas. This regulation regulates the marketing of fluorinated greenhouse gases through prohibitions and restrictions. Specifically, it establishes a system of quotas for hydrofluorocarbons that can be placed on the EU market each year. The regulation currently in force was adopted in 2014, and the European Commission published in April 2022 the proposal for the revision of the regulation. Recently, in March the Parliament and in April the Council made their positions public.

The revision of the F-Gas Regulation

The Commission’s proposal for the revision of the F-Gas regulation introduced some new bans on top of those already in place; but above all it established a more accelerated phase-down schedule for hydrofluorocarbons (HFCs). Following the EU legislative process, this Commission proposal must now be approved by the European Parliament and the EU Council. The Parliament has tabled a number of amendments in March to add new bans, but these need to be agreed between the parties. The Council has also submitted its report.

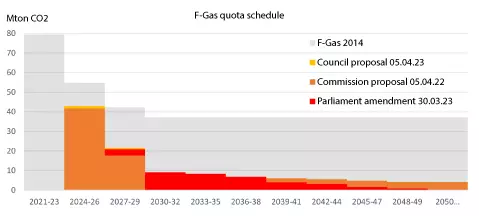

The Commission, Parliament and Council have not yet agreed on many terms, but what they do agree on is a drastic reduction in the annual quota of HFCs that can be placed on the EU market in the coming years. The 2014 regulation established a phased reduction schedule to approximately half of the current HFC quota by 2030. This schedule was to be revised to meet the Kigali targets from 2034. However, the F-Gas revision proposes a much more aggressive timetable: the quota would be reduced by approximately half every 3 years, until the near eradication of HFCs.

Evolution of F-Gas consumption in Spain

Since the F-Gas regulation came into force in 2015, it has been possible to reduce the annual consumption of these gases in Spain, measured by their greenhouse effect, from 32 to 12 million tonnes of CO2 equivalent. This has largely been possible thanks to substitute gases with a moderate greenhouse effect.

However, the consumption of fluorinated gases seems to have stagnated over the last five years. There is no longer any substitute gas that can further reduce the greenhouse effect. Refrigeration remains the big demand sector, and the reduction in gas consumption due to the slow pace of transformation of this sector to alternative solutions is counterbalanced by the increase in activity.

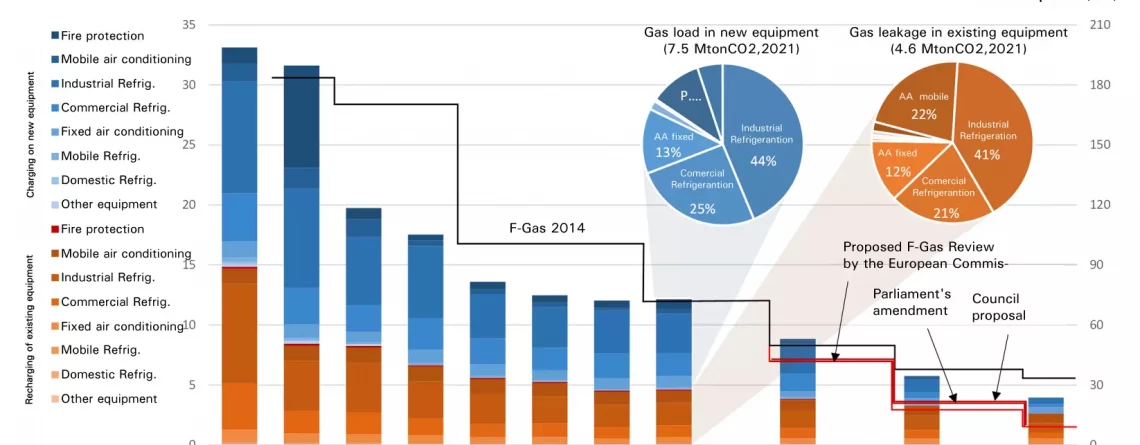

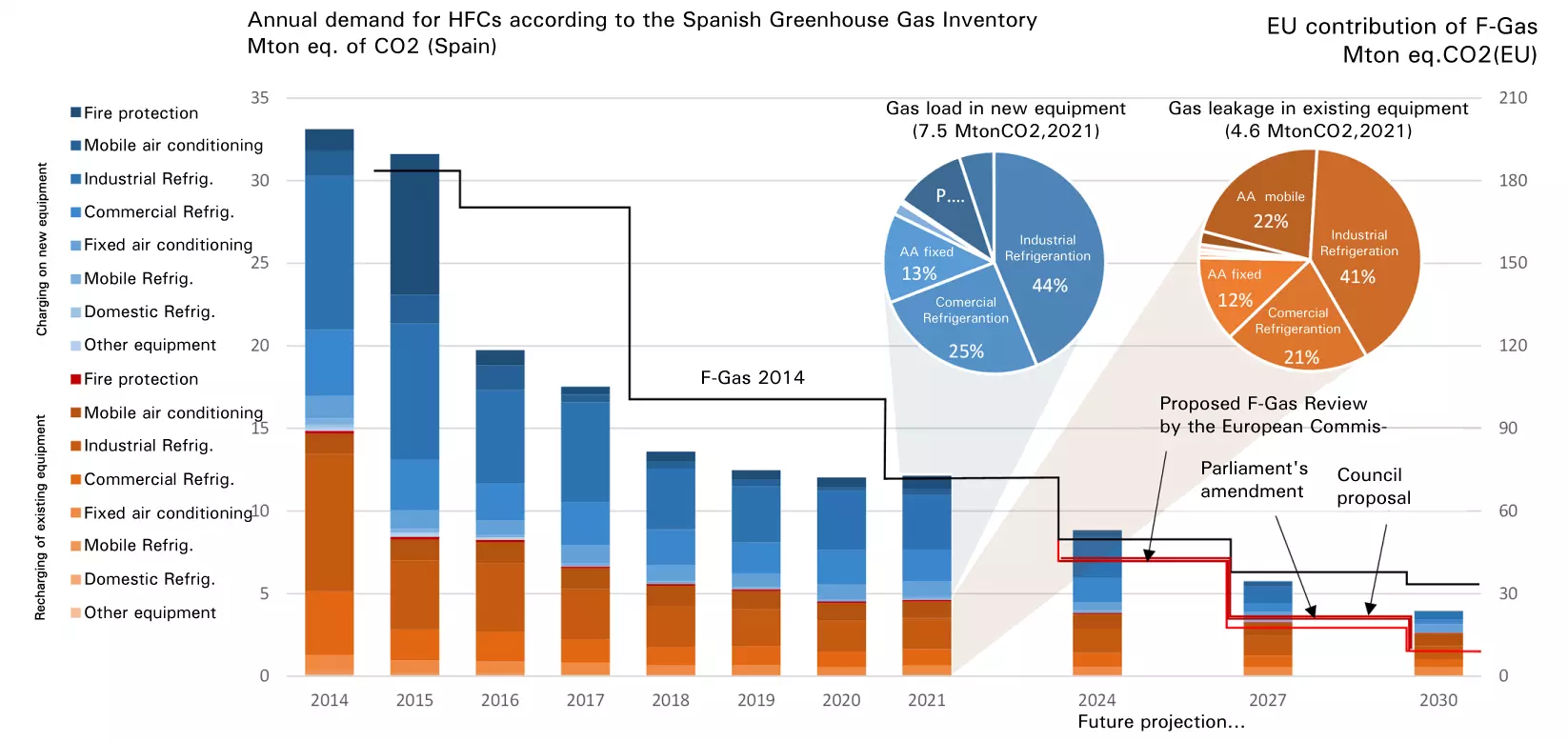

The following graph shows the evolution of hydrofluorocarbon consumption in Spain from 2014 to 2021. It has been elaborated with data extracted from the Spanish Greenhouse Gas Inventory. The graph includes both gas incorporated in new equipment and gas leakage from existing equipment. The latter are mainly deducted from gas consumption for maintenance of the equipment fleet. The graph is compared with the quota reduction of the EU-wide F-gas regulation, which is represented on a different scale on the right axis. Both graphs have been superimposed to roughly match the consumption in Spain in 2021 with the quota available that year for the whole EU.

Evolution and future projection of HFC consumption in Spain vs. F-Gas quotas in the EU. Prepared by the authors based on data from the National Greenhouse Gas Inventory for 2023.

The end of fluorinated gases

For 2024, 2027 and 2030, an exercise has been carried out to project the future demand for fluorinated gas in the Spanish market. The projection takes into account the implementation of future use bans and the maintenance needs of the equipment fleet. This allows us to compare the evolution of the expected demand with the evolution of the available EU quota.

In the best case scenario, the industry could comply with the initial reduction schedule of the 2014 F-Gas regulation; but the imminent revision of the regulation with the acceleration of the timetable would lead to a shortfall in the supply of fluorinated gas from 2024 onwards. It will be much worse from 2027 onwards, where the demand for gas for refuelling existing equipment will be barely covered, while in 2030 there will be no gas even for maintenance of the equipment fleet.

In the meantime, this has already started the escalation of the price of fluorinated gas towards the end of the year. But the important thing is that we have to be aware that we are witnessing the decline of fluorinated gases, and that the whole sector needs to adapt now to alternative solutions: glycol, R290, CO2 and ammonia.